Bridge the gap between raw data and actionable insights with Taghash’s Dealflow BI

Struggling to make sense of investment data? Taghash's Dealflow BI transforms it into actionable insights for better decision-making.

Taghash provides end-to-end workflow solutions for Venture Funds, Private Equity and other Alternative Investment Funds. For the last 7 years, we have been working as a tech arm for top VCs to manage their Dealflow, Portfolio, Fund and Limited Partners.

We understand that working in a VC fund revolves around constantly sifting through mountains of data. While interacting with our customers, we realized that the traditional and inadequate methods of hashing out insights from dreary spreadsheets and dull charts are also something that needs an upgrade.

And that’s how Dealflow BI was born.

What is it, you ask?

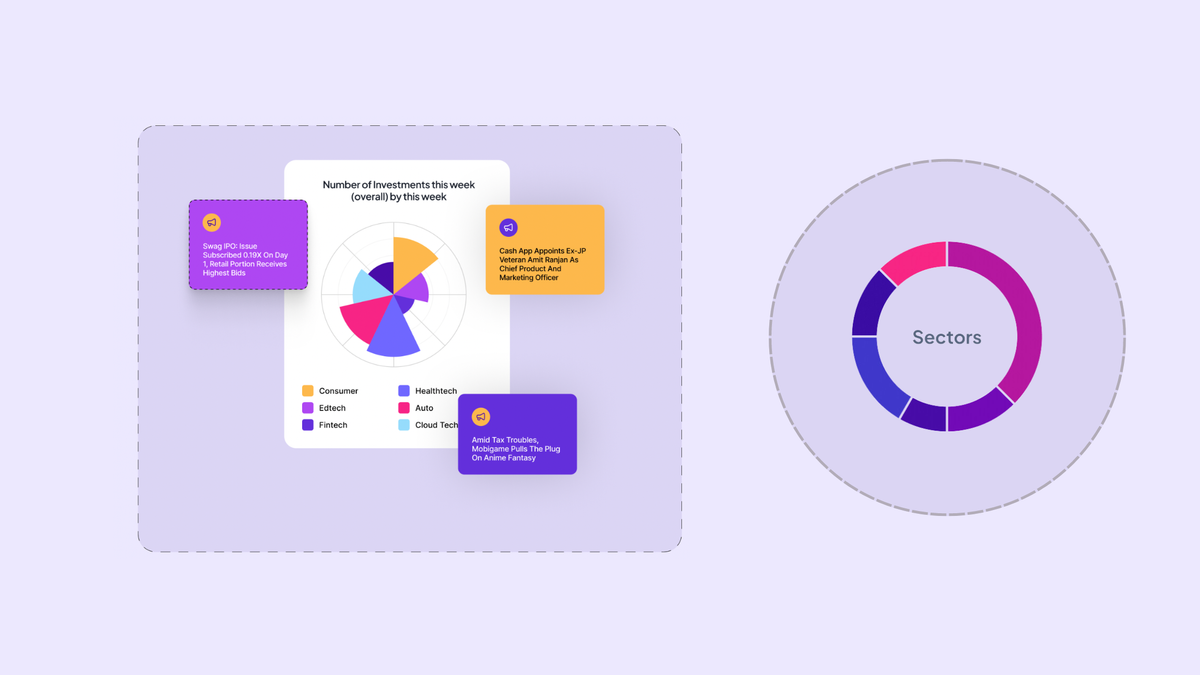

Think of it as a wizard that transforms your raw data into vivid, actionable insights using advanced analysis and visualization tools.

It supports all types of custom analytics and queries, allowing you to fine-tune your analysis process to meet your specific needs and objectives.

Now let’s see what Dealflow BI can help you:

Unlocking Insights with Enhanced Analysis

Dealflow BI transforms complex data into actionable insights with advanced analysis and intuitive visualization. VCs can easily discern trends, assess risks, and seize opportunities, making data-driven decisions a breeze.

Simplified Decision-Making with Streamlined Evaluation

By organizing and prioritizing information, Dealflow BI simplifies the evaluation process. This saves time and supports confident, data-driven decisions, reducing uncertainty and boosting investment success rates.

Staying Ahead with Proactive Risk Management

Dealflow BI helps VCs identify and mitigate risks early on, safeguarding their portfolios from potential threats. Its robust analysis and visualization capabilities provide a competitive edge, enabling better decisions and higher returns.

Building Optimal Portfolios with Smart Insights

Dealflow BI empowers VCs to construct and optimize portfolios effortlessly. With key metrics readily available on a single dashboard, VCs can identify promising opportunities and fine-tune their portfolios for maximum performance.

To know more about Dealflow BI or other features of Taghash, click here to schedule a demo.