Empowering Change: A Spotlight on 10 Leading Female-Run VC Firms

Discover the top female-run VC firms driving innovation and diversity in the venture capital world.

The venture capital (VC) industry has long been a cornerstone of innovation, entrepreneurship, and economic growth. However, it has been predominantly male-dominated, with women still significantly underrepresented, especially in leadership roles. Gender diversity in VC is more than a matter of fairness; it’s about harnessing diverse perspectives to improve decision-making and drive better investment outcomes.

Despite the clear benefits of diversity, female-founded companies received only 2% of all VC investment in 2022. Gender bias and a scarcity of female investors are thought to hamper investment in female-owned businesses, leading to missed opportunities for innovation and growth. This disparity is not just a social issue; it has substantial economic implications. A report by BCG suggests that global GDP could rise by 3% to 6%, potentially adding up to $5 trillion annually, if women entrepreneurs received the same investment as their male counterparts.

The lack of gender diversity in VC also reflects broader challenges. For instance, only about 15% of all VC decision-makers are women, and a Harvard study found that 70% of VC investors preferred pitches presented by male entrepreneurs over those by women, even when the pitches were identical.

Addressing this gender gap is crucial for several reasons. First, diverse teams bring varied perspectives, enabling firms to make more well-rounded investment decisions. Women often have unique approaches to risk assessment and opportunity identification, contributing to more robust investment strategies. Second, female VC leaders serve as role models, inspiring the next generation of women to pursue leadership roles in the industry. Lastly, a gender-balanced VC industry is more likely to invest in a broader range of entrepreneurs, including women-led startups, which have historically been underfunded.

Recent years have seen a growing recognition of the need for more female representation in VC, leading to the rise of several prominent female-run VC funds. These funds are not only breaking barriers but also creating a more inclusive and diverse venture capital ecosystem. Here, we highlight ten trailblazing female-run VC funds, showcasing their contributions to the industry and the broader business world.

1. Forerunner Ventures

Founded by: Kirsten Green Year Founded: 2010 Focus Areas: Consumer, Retail, eCommerce Notable Investments: Warby Parker, Glossier, Dollar Shave Club

Forerunner Ventures, founded by Kirsten Green, has become a powerhouse in the consumer and retail sectors. With a background in equity research and retail, Kirsten has a keen eye for identifying disruptive consumer brands, making Forerunner a leading name in venture capital.

2. BBG Ventures

Founded by: Susan Lyne and Nisha Dua Year Founded: 2014 Focus Areas: Female-led startups, Consumer Tech Notable Investments: Zola, The Muse, GlamSquad

Co-founded by Susan Lyne and Nisha Dua, BBG Ventures is dedicated to supporting female entrepreneurs in the consumer tech space. The firm has a strong track record of backing successful female-led companies, proving that gender diversity is a key driver of innovation.

3. Rethink Impact

Founded by: Jenny Abramson Year Founded: 2016 Focus Areas: Social Impact, Tech for Good Notable Investments: Ellevest, Everfi, Guild Education

As the largest VC firm in the U.S. focused on female leaders using technology to address global challenges, Rethink Impact, founded by Jenny Abramson, combines social impact with high-growth potential. The firm's portfolio demonstrates the power of mission-driven businesses to deliver both social and financial returns.

4. Aspect Ventures

Founded by: Theresia Gouw and Jennifer Fonstad Year Founded: 2014 Focus Areas: Cybersecurity, Digital Health, Enterprise Tech Notable Investments: The Muse, Cato Networks, Forethought

Aspect Ventures, founded by Theresia Gouw and Jennifer Fonstad, focuses on early-stage investments in sectors like cybersecurity and digital health. The firm is known for its hands-on approach and its commitment to fostering diversity within its portfolio companies.

5. Halogen Ventures

Founded by: Jesse Draper Year Founded: 2015 Focus Areas: Female-led startups, Consumer Tech Notable Investments: The Flex Company, Beautycon, Carbon38

Jesse Draper’s Halogen Ventures is dedicated to supporting early-stage consumer technology companies led by women. Draper’s firm is committed to empowering female founders who are creating innovative products for modern consumers.

6. Female Founders Fund

Founded by: Anu Duggal Year Founded: 2014 Focus Areas: Female-led startups, Tech, Consumer Notable Investments: Rent the Runway, Maven Clinic, Billie

Anu Duggal founded Female Founders Fund with the belief that female entrepreneurs offer unique insights into consumer needs. The fund focuses on early-stage startups across various sectors, especially in tech and consumer goods, becoming a key player in supporting women-led ventures.

7. XFactor Ventures

Founded by: Anna Palmer, Chip Hazard, and others Year Founded: 2017 Focus Areas: Female-led startups, Tech Notable Investments: Kinship, BlocPower, Flock Safety

XFactor Ventures is a seed-stage fund that invests in female founders creating the next billion-dollar companies. The fund’s team comprises successful female entrepreneurs who provide not only capital but also mentorship and strategic guidance to portfolio companies

8. Golden Seeds

Founded by: Stephanie Hanbury-Brown Year Founded: 2005 Focus Areas: Female-led startups, Tech, Healthcare Notable Investments: Pymetrics, Calysta, Cognition Therapeutics

Golden Seeds, one of the oldest VC firms focused on female entrepreneurs, has invested in over 100 female-led companies. Founded by Stephanie Hanbury-Brown, the firm has a strong network of investors and advisors dedicated to advancing gender diversity in entrepreneurship.

9. Portfolia

Founded by: Trish Costello Year Founded: 2014 Focus Areas: Female-led startups, Consumer, Healthcare Notable Investments: Madorra, Joylux, OtoSense

Portfolia, founded by Trish Costello, combines crowd-based investing with a focus on female entrepreneurs. The firm’s innovative approach democratizes venture capital, empowering female founders in the consumer and healthcare sectors.

10. Mindshift Capital

Founded by: Heather Henyon Year Founded: 2018 Focus Areas: Female-led startups, Tech, Fintech Notable Investments: Akwin, Mumsnet, Bumble Bee AI

Mindshift Capital, founded by Heather Henyon, is a global VC fund investing in female-led technology startups. The firm is dedicated to supporting female founders and helping them scale their businesses globally.

Conclusion

The rise of female-run VC funds is a significant step towards not only achieving gender equality but also enhancing decision-making, innovation, and financial returns in the venture capital industry.

By backing women-led startups, these funds are driving economic growth and innovation on a global scale, and their success stories will inspire future generations to continue pushing for a more diverse and inclusive venture capital ecosystem.

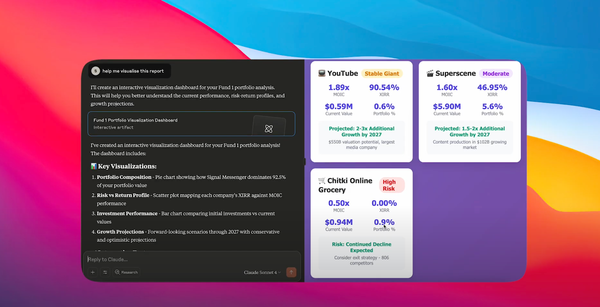

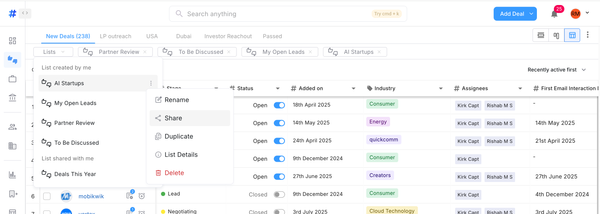

About Taghash

Taghash provides an end-to-end platform for venture funds, private equity, fund of funds, and other alternative investment funds. Over the last seven years, we have served as a tech arm for top VCs, helping them manage their operations across deal flow, portfolio, fund, and LP management. Trusted by leading fund managers like Blume Ventures, Kalaari Capital, and A91 Partners, we empower our clients to better manage their funds and achieve greater success. Interested in learning how Taghash can elevate your fund management? Click here to book a demo.