From Tracking to Reporting: How Taghash Enables Fund Management

Ready to elevate your fund management? Discover how Taghash can streamline your workflow and boost your performance.

As a venture capital or private equity fund manager, you're tasked with a myriad of responsibilities, from optimizing portfolio performance to ensuring regulatory compliance. However, amidst the thrill of investing in groundbreaking companies, the reality of administrative burdens and data silos can often weigh heavily on your shoulders.

Picture this: You're juggling multiple hats — analyst, strategist, mentor — all while striving to keep your fund's performance on track. Yet, as the demands of fund management grow, so too does the complexity of your tasks. From tracking real-time performance metrics to maintaining compliance across diverse portfolios, the sheer magnitude of responsibilities can seem overwhelming.

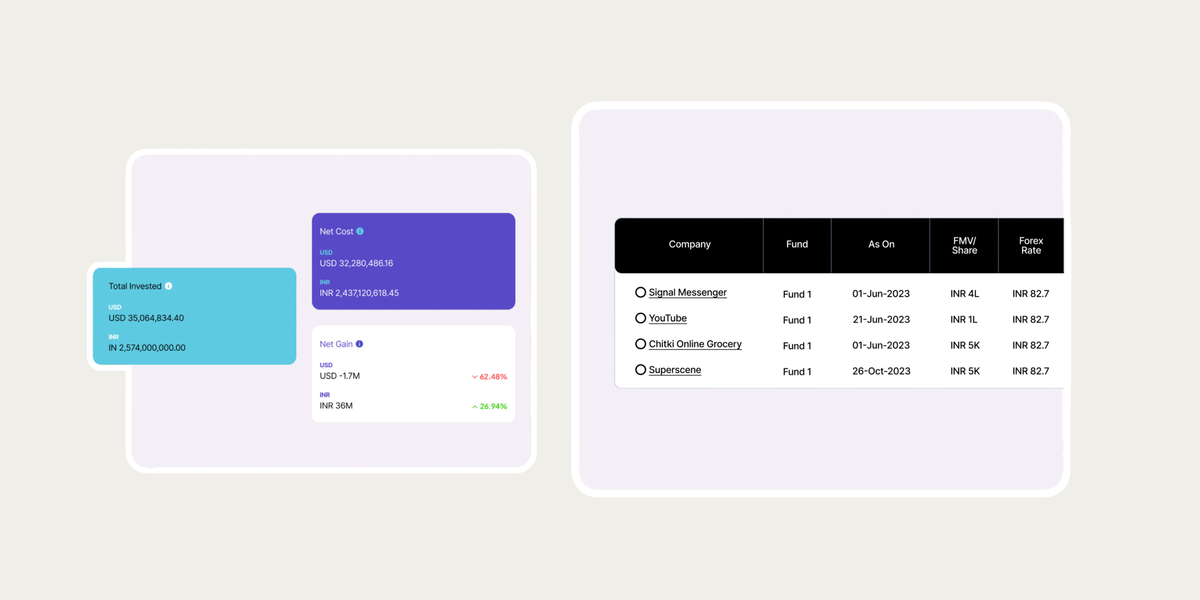

Enter Taghash - with easy-to-understand calculation, tracking and visualizations of key metrics. Here, you can track progress towards fund-level goals, identify potential issues, and align your team to work towards shared objectives.

Let’s have a look at the core benefits you would enjoy with Taghash at your disposal -

Simplify Fund Management

Effortless FoF (Fund of Funds) Management: Manage multiple funds within a fund of funds structure seamlessly, streamlining complex portfolio management.

Multiple Fund Performance Comparison: Compare multiple funds side by side, identifying top performers and optimizing fund allocation.

Seamless Multiple Currency Support: Operate globally with ease. Manage multiple currencies seamlessly, facilitating cross-border transactions and reporting.

Empower Your Team with Seamless Ownership Tracking & Communication

Effortless Ownership Tracking: Simplify complex ownership structures by tracking investments and ownership percentages across multiple Special Purpose Vehicles (SPVs) and funds.

Single Source of Truth: Manage risk, ownership, and allocation on a single system. Query, analyze, and evaluate data metrics as per your unique assessment criteria.

Efficient Communication Across Workspaces: Foster teamwork and streamline communication among team members and partners. Configure visibility and permissions for data access and task management.

Free up your time with Effortless Compliance & Reporting

Comprehensive Reports in One Click: Generate shareable, customized reports with key metrics that showcase fund performance. Present clear, consistent data to foster investor confidence.

Ready to streamline your fund management? Click here to book a demo and learn more about this and other products specifically designed for private investors.